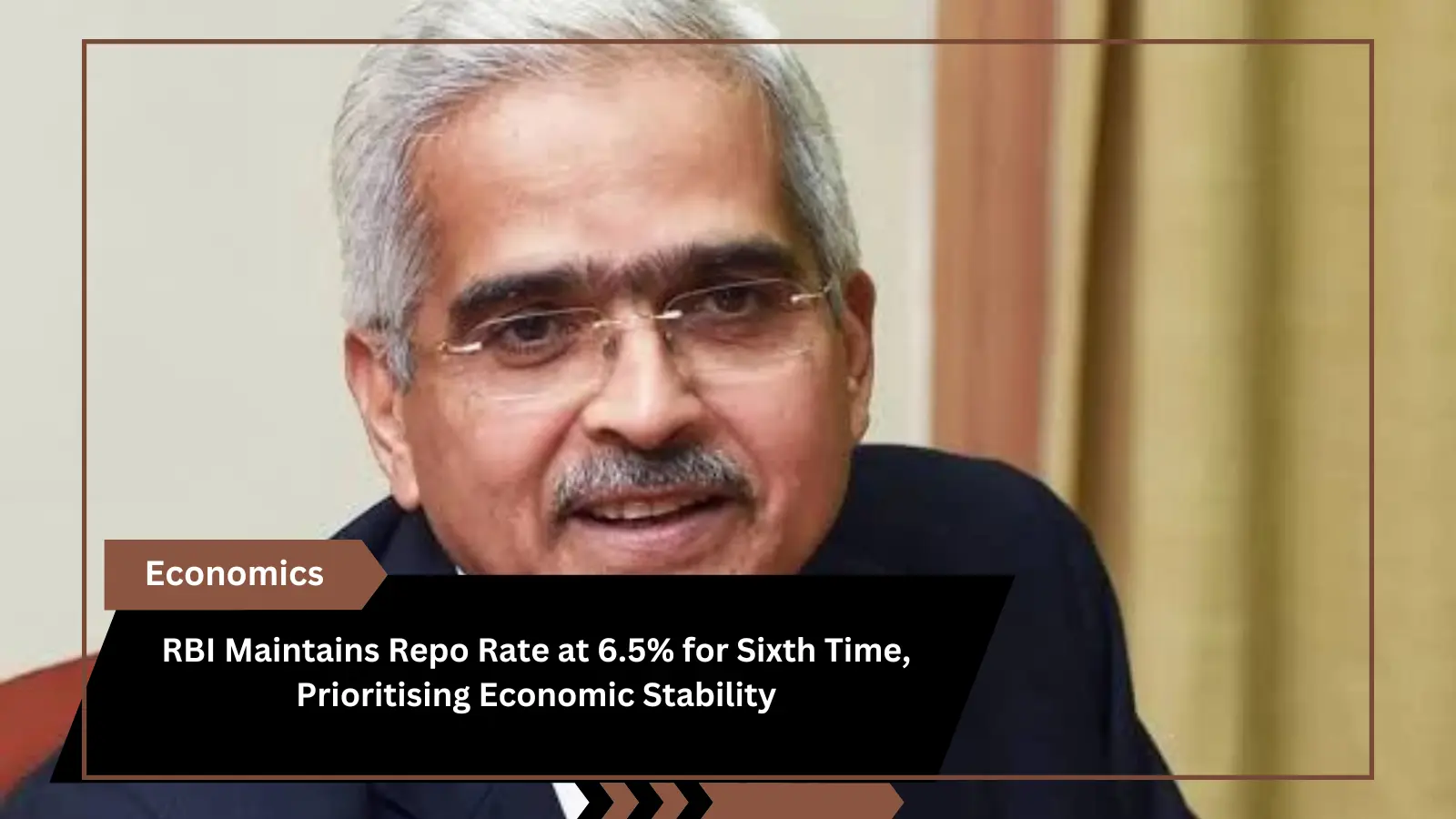

RBI’s Commitment to Economic Stability Reflected in Maintained Repo Rate Amidst Uncertain Global Environment

On February 8, in its last Monetary Policy Committee (MPC) meeting under the Reserve Bank of India (RBI), it becomes clear that the repo rate stands at 6.5%. This constitutes the sixth occasion when nothing has changed in recent days and whereby this rate of monetary policy key was left without change. The decision emphasizes RBI’s commitment to keep calm in the changing economic wave.

Governor Shaktikanta Das pointed to the unceasing food prices uncertainty sustaining to influence headline inflation. Yet he observed that the local economic activities have shown signs of great vitality. Further highlighting the importance of an active dis-inflationary monetary policy, Das reaffirmed the RBI’s commitment to attaining its inflation objective underlining growth.

The position to retain the repo rate is introduced against a background of an optimistic world economic perspective in which there will be stable growth rates amid differences between regions. Although the world trade momentum is slow, measures of recovery are evolving which seem to indicate an acceleration in growth by 2024. In addition, inflationary pressure has significantly tempered and is projected to continue easing in the rest of 2016.

When the RBI met in December 2013 for its monetary policy decision, it did not change the repo rate despite being on a holding pattern since August this year as voted by Governor Das reducing the growth estimates to 7 percent from the existing estimate of 6.5 percent On the other hand, there was majority support on part of those who attended the MPC comprising six members when they agreed to retain Bank rate at its current level.

Although retail inflation has fallen away from its peak level during July 2023 and is presently at 5.69 percent in December of this same year, it nevertheless stays within the RBI’s comfort zone set between four to six percent. As the future looks ahead, Governor Das expressed encouragement toward economic growth in India as he estimated a 7 percent rate of increase for the fiscal period following it. He attributed the recent structural reforms that have been embarked on by the government will help strengthen medium and long-term growth prospects.

The interim budget address by Finance Minister Nirmala Sitharama, too reflected in solidifying recommendations like fiscal consolidation and spending on infrastructure building besides investments in the long term for reforms that would spur the growth of the economy.

Overall, the regulatory body’s retention of the status quo on the repo rate is indicative of its conservative stance responsive to changing dynamics in an economy where balancing inflation and fuel for growth was kept darting.